We’re seeing new data from Federal Student Aid (FSA) for the Public Service Loan Forgiveness (PSLF) program. See statistics here. In the past, several news articles have covered the abysmal PSLF approval rates. Now we see FSA has taken a different approach to its statistics, which highlights the fact that many of the borrowers who apply for PSLF do NOT qualify for PSLF because it simply has not been long enough (10 years or 120 payments) for PSLF approval. Unfortunately, in many circumstances, it’s the result of the borrower consolidating their student loans into new Direct Loans, which starts over the clock (10 years/120 payments).

Good News:

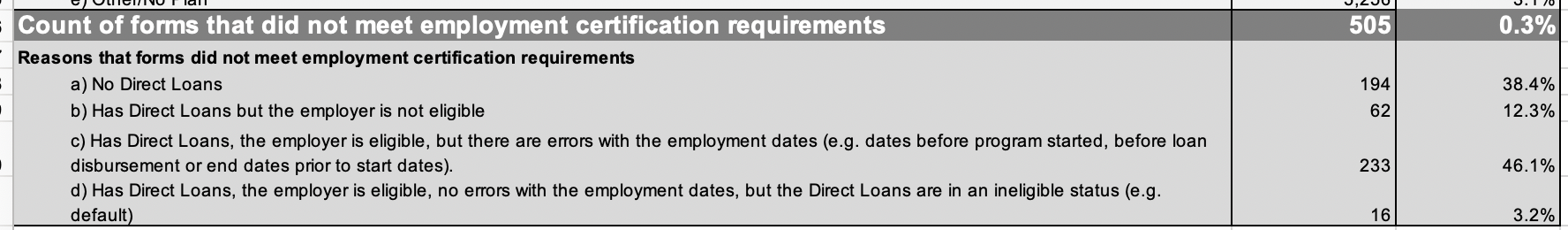

- Almost everyone who has everything they need for their employment certification portion of their PSLF application (now that it’s combined), will get credit for their employment. But…isn’t that like saying everyone who qualifies will qualify? See screenshot below for forms that don’t meet employment certification requirements.

- “Almost all (99.7%) of the 168,000 completed and processed applications came from borrowers whose loans and employment meet the legal requirements to receive credit toward PSLF.”

- “Cumulatively, 1.25 million borrowers have had their employment eligibility certified and have received a qualifying payment count so they can keep track of where they stand on attaining PSLF.”

- “5,500 borrowers have received PSLF discharges thus far, totaling $453 million.” “3,000 borrowers have received TEPSLF discharges totaling $130 million.” Good for them, but this number seems a bit low.

- FSA blames the fact that the program only began in 2007, so the earliest someone could have qualified is 2017: “Over 82% of borrowers who do not yet qualify for forgiveness have eligible loans that have been in repayment less than 120 months, meaning they could not yet have accumulated the required 120 months of qualifying employment or qualifying payments.”

- FSA further attributes the low rates to the consolidation issue: “One notable problem here relates to borrowers who consolidated older federal student loans into new Direct Loans and then were made to start over on a brand-new clock; they did not get credit for employment or payment activity on their prior loans. This issue merits further consideration.” YES, we agree, it does merit further consideration.

Bad News

- So clearly from above, we see there’s a problem with consolidating and restarting the PSLF clock. As it turns out, the numbers show the depth of this issue:

- “In the meantime, however, close to half the borrowers who do not yet qualify for PSLF on this basis are held back by this treatment of their consolidated loans.” YIKES. Were these borrowers aware of the restart of the PSLF clock before they consolidated? Maybe congressional action can help in the near future.

- Missing necessary information on PSLF forms

- “Since the new form was implemented (through April 2021), FSA has received more than 391,000 applications from approximately 322,000 borrowers. Of these, more than 168,000 have been completed and processed, 146,000 remain in processing, and 76,600 were missing necessary information.”

- If we’re looking at the rates of “missing necessary information,” let’s do the math: 76,600 missing info apps/(168,000 completed apps + 76,600 missing info apps)= 76,600/244,600 = 31.3% of PSLF forms that FSA has processed are missing information, which in turn, results in denial.

Links:

https://studentaid.gov/sites/default/files/fsawg/datacenter/library/PSLF-april2021.xls

https://studentaid.gov/data-center/student/loan-forgiveness/pslf-data