NOTE: This is a repost from the Department of Education’s Official Blog

On Dec. 4, 2020, the secretary of education extended the 0% student loan interest rate and suspension of payments on federal student loans owned by the Department of Education (ED). These relief measures began on March 13, 2020, and below you’ll find a recap of the resulting repayment flexibilities for student loan borrowers and relevant considerations.

Check out StudentAid.gov/coronavirus for the latest updates.

1. If You’re Struggling Financially, You Have Multiple Payment Options

If you are worried you won’t be able to make your next payment after the payment suspension ends, you have options.

ED offers a variety of income-driven repayment (IDR) plans based on your income. Under an IDR plan, payments may be as low as $0 per month.

Check out StudentAid.gov’s Loan Simulator to learn how switching your repayment plan could impact your monthly payment amount before your next bill.

After understating all your repayment options, you can apply for a specific plan or ask to be placed on the repayment plan that results in the lowest monthly payment amount.

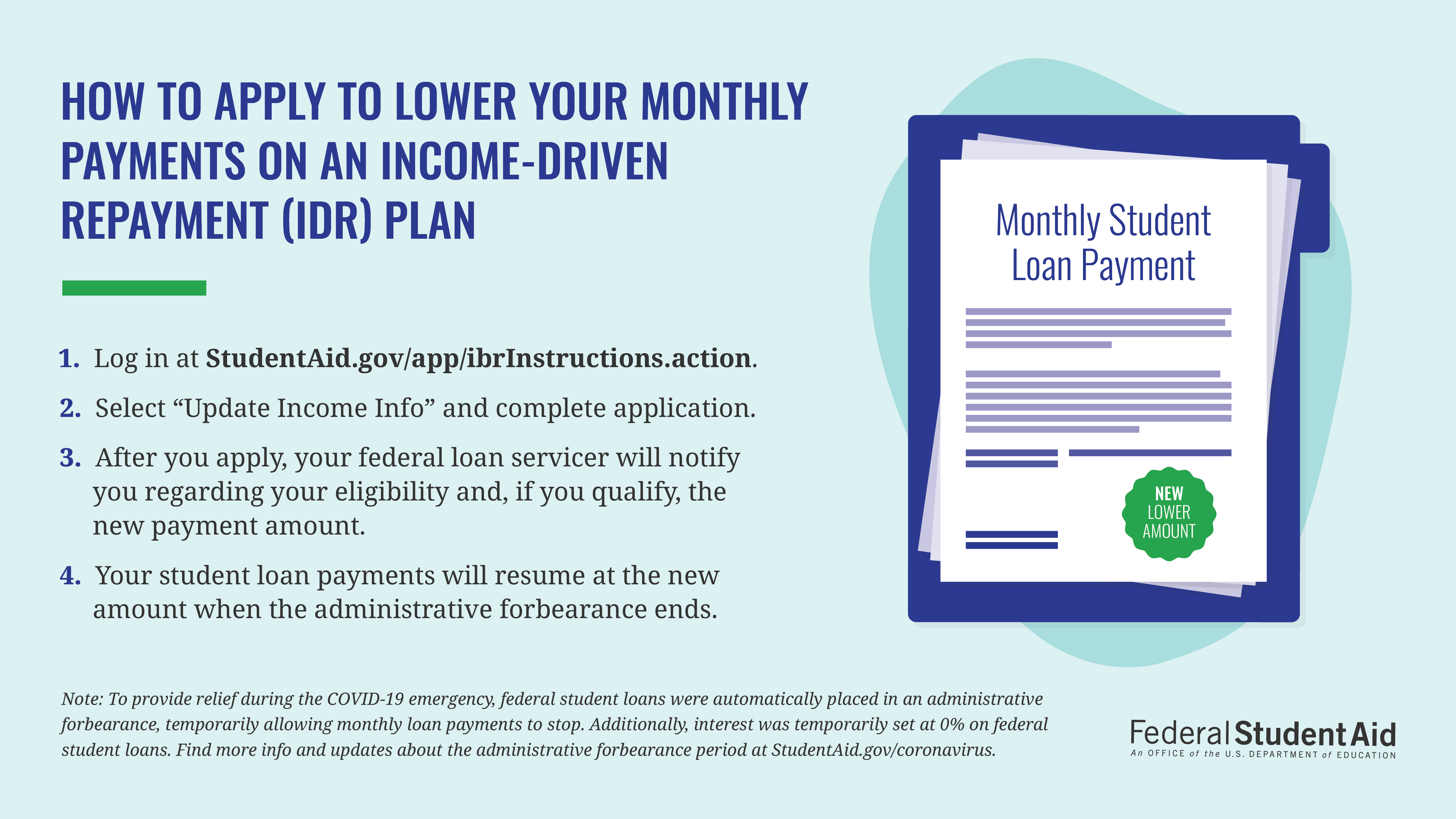

If you are already on an IDR plan but are currently unemployed because of the COVID-19 emergency, you can update (recertify) your information to see if you qualify for a new, lower payment amount by logging in and complete the steps below:

Any changes to your payment amount will take effect after the payment suspension ends.

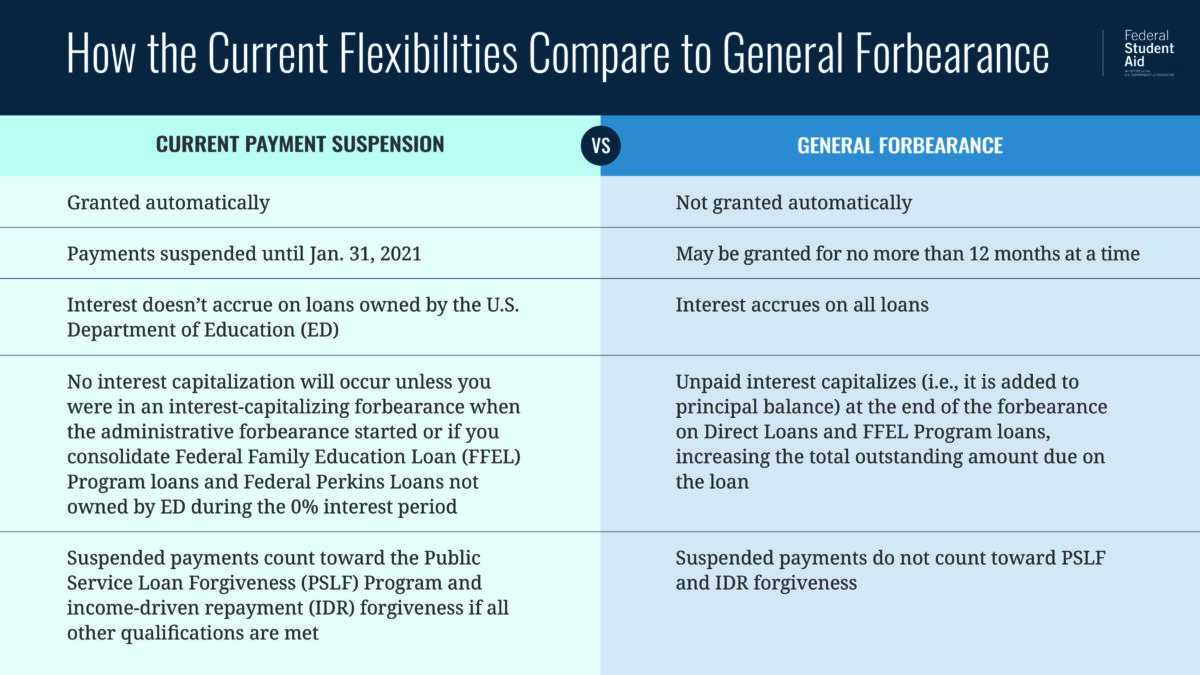

If none of these options seem beneficial to you, contact your loan servicer to discuss additional forbearance options after the payment suspension ends. However, please remember that interest accrues for most borrowers on a general forbearance.

2. Stay Tuned For Updates From Your Loan Servicer

As part of the administrative forbearance, your IDR recertification date has been changed from your original recertification date. You will be notified by your loan servicer when it is time to recertify.

If you were paying your student loans using automatic debit earlier this year, your automatic payments will resume after the COVID-19 emergency relief measures end. If you’d like to make a change to your payment method, you must contact your loan servicer online or by phone.

If you’re unsure about your next payment amount, contact your loan servicer to confirm your upcoming payment amount. This info may be available to you online by logging into your loan servicer’ s website.

3. Your Monthly Payments Are Suspended for ED-Owned Loans

ED placed your ED-owned student loans in a payment suspension that started March 13, 2020. This means you don’t have to make monthly payments during this time. If you made a payment during this time, you can request a refund through your loan servicer.

Federal loan servicers were directed to report to credit reporting agencies as if regularly scheduled payments were occurring during the payment suspension period. Delinquency will not be reported during the payment suspension period.

Generally speaking, if you were up to date on your payments before the payment suspension period began, interest accrued prior to March 13, 2020, will not capitalize. This means no outstanding interest will be added to your principal balance when the payment suspension ends.

However, if you were in the type of deferment or forbearance in which interest would normally capitalize prior to the payment suspension period, then interest accrued prior to March 13, 2020, will capitalize when your original deferment or forbearance ends or on Feb. 1, 2021, whichever is later.

If you were in your grace period before the payment suspension period began, any outstanding or unpaid interest on your account will capitalize as it usually does when you enter repayment.

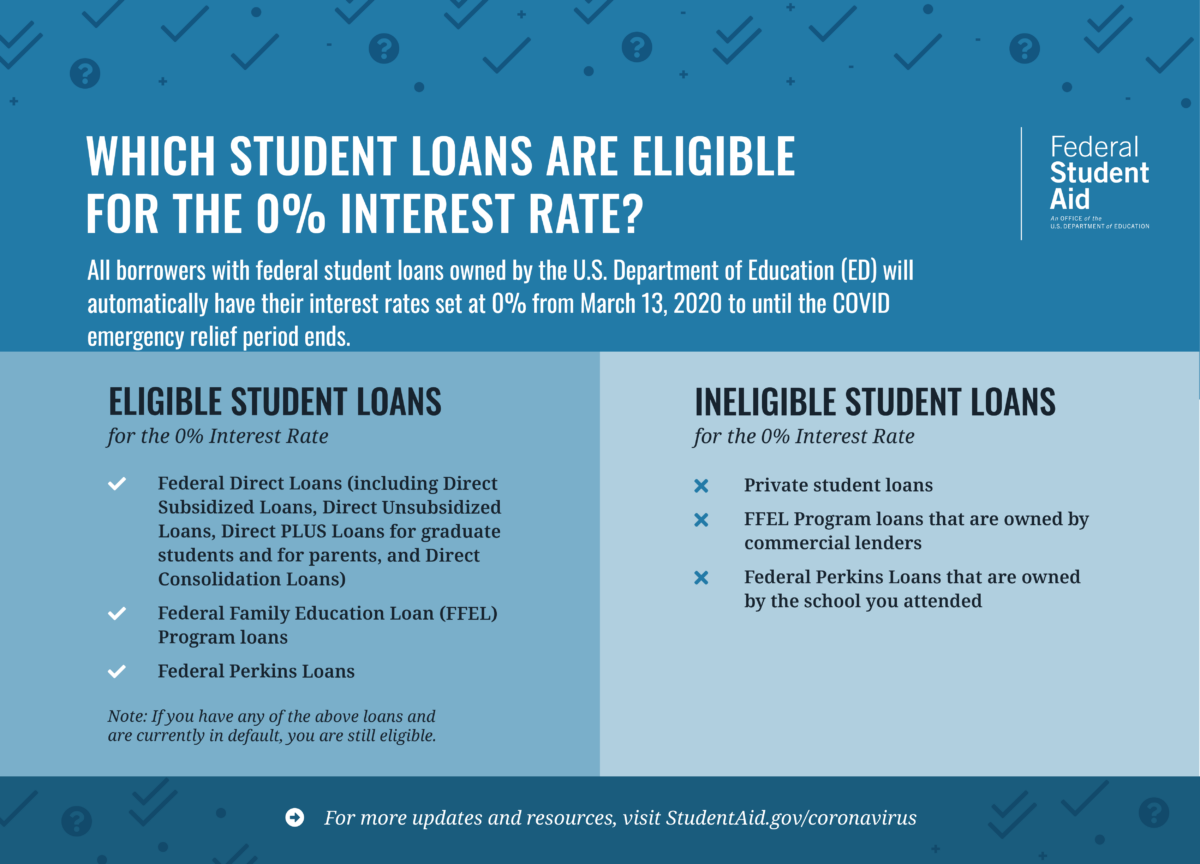

4. Temporary 0% Interest Rate on Loans Owned by ED

From March 13, 2020, to the end of the payment suspension period 0, the interest rate on ED-owned student loans is automatically set at 0%. That means your student loans will not accrue (i.e., accumulate) interest during this time.

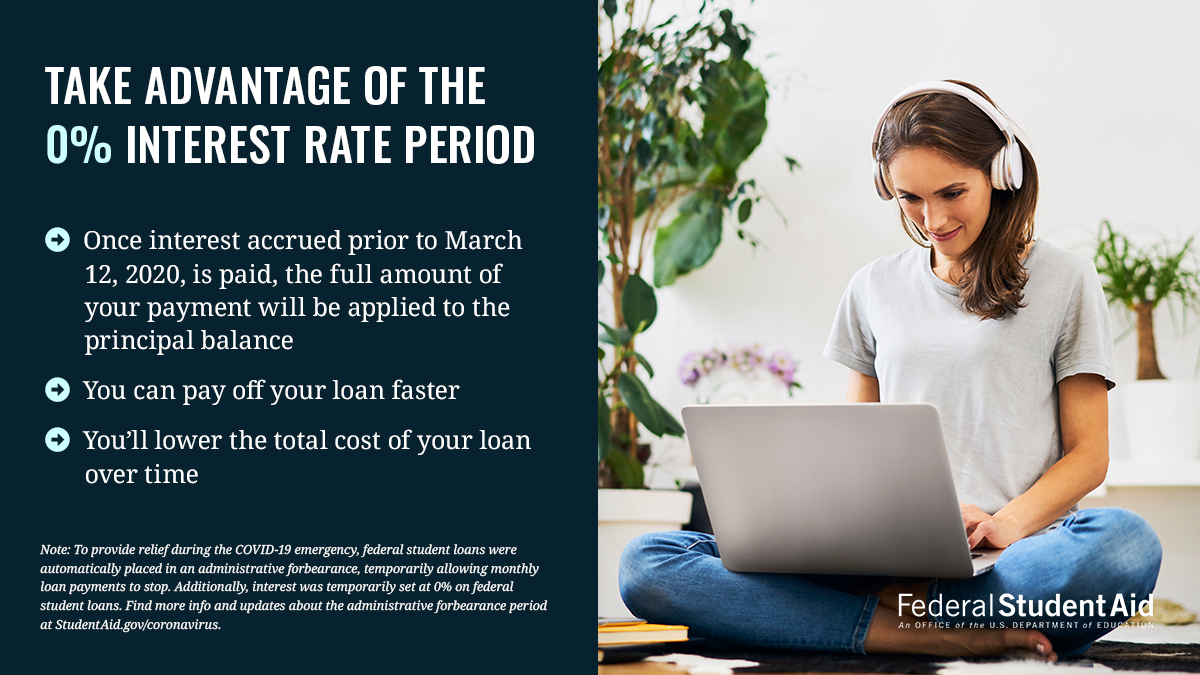

If you are able, continuing to make manual payments on the loan servicer’s website has some benefits.

5. Avoid Coronavirus-Related Scams!

There is no fee for this payment suspension or 0% interest period—not from the federal government and not from your loan servicer. If someone asks for money for either of those reasons, it’s a scam. Your loan servicer provides free help with your questions or concerns about your loan payments. There is no coronavirus-related loan forgiveness for federal student loans. Learn more about avoiding student aid scams.

Disclaimer: This article contains general statements of policy under the Administrative Procedure Act issued to advise the public on how ED and Federal Student Aid (FSA) propose to exercise their discretion as a result of and in response to the lawfully and duly declared COVID-19. ED and FSA do not intend for this article to create legally binding standards to determine any member of the public’s legal rights and obligations for which noncompliance may form an independent basis for action.