The Department of Education has released new PSLF data from November 9, 2020 to January 31, 2022 and November 9, 2020 to February 28, 2022. Around 99.6-99.7% of ECF’s that met the requirements resulted in an updated count. Around 1.6-1.7% of PSLF forms were forgiven under traditional PSLF (as opposed to traditional TEPSLF) because most people did not have 120 monthly payments yet.

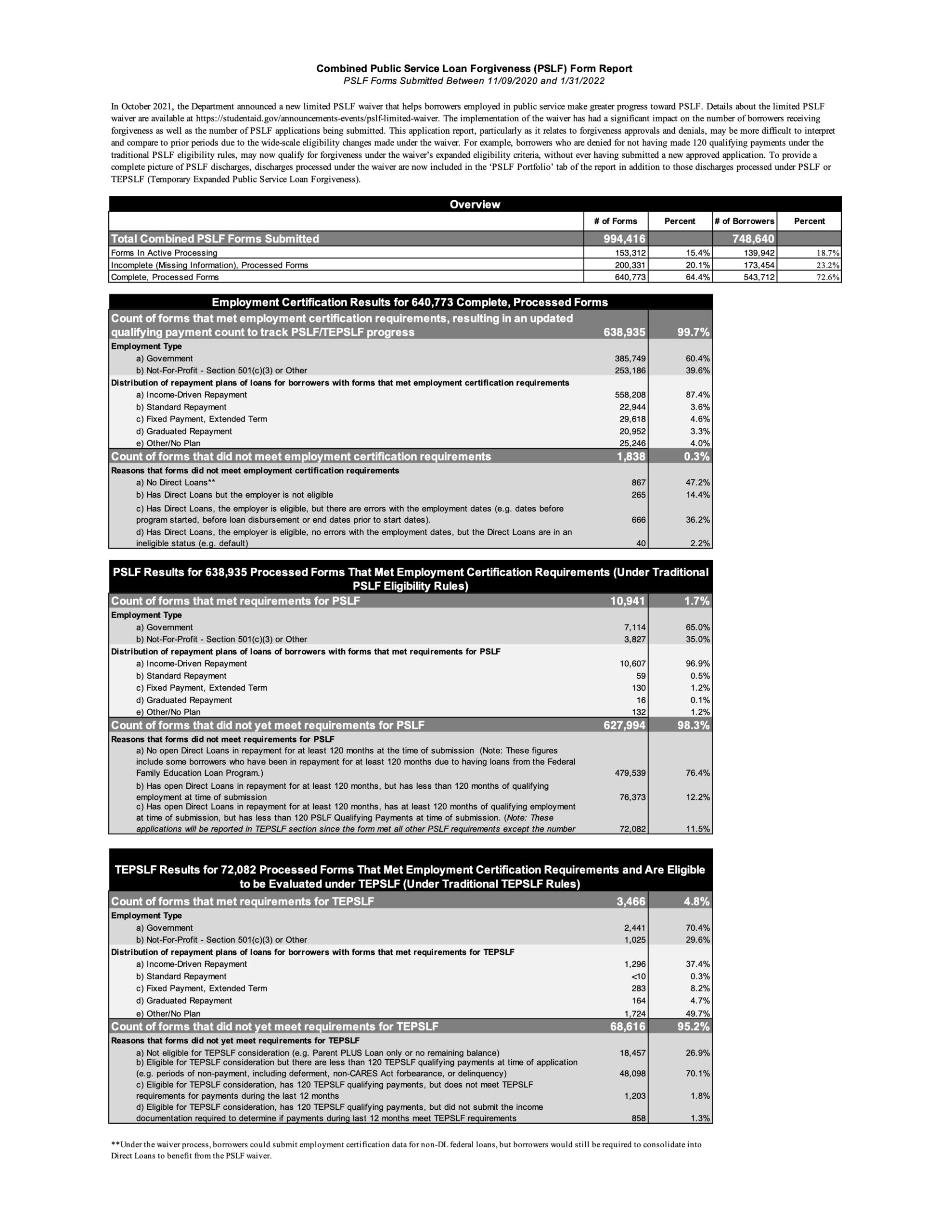

November 9, 2020 to January 31, 2022

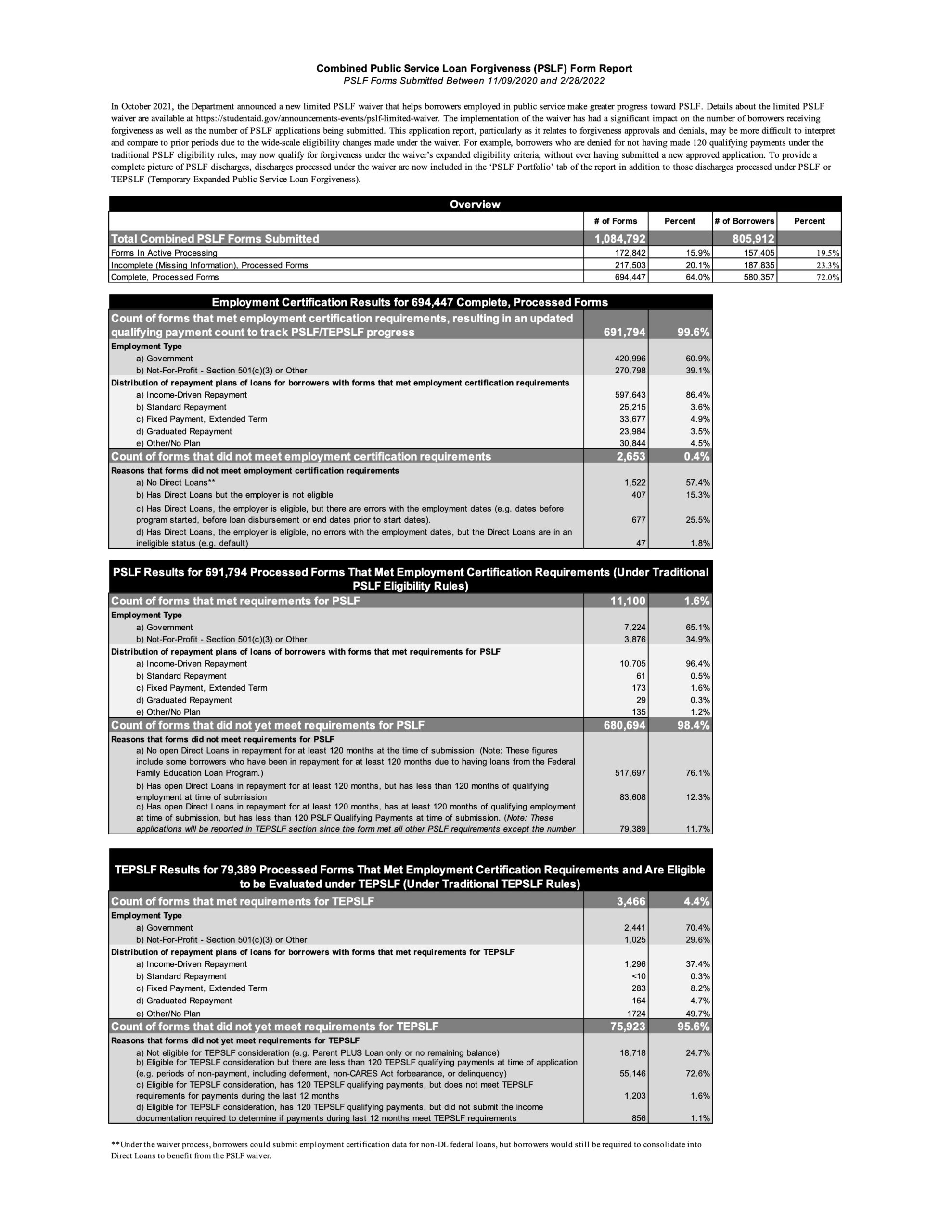

November 9, 2020 to February 28, 2022

For background information, according to the Department of Education:

Federal Student Aid began accepting and reviewing applications from borrowers seeking loan forgiveness under the Public Service Loan Forgiveness (PSLF) Program in the fall of 2017. The PSLF Program, which was established under the College Cost Reduction and Access Act of 2007, permits Direct Loan borrowers who make 120 qualifying monthly payments under a qualifying repayment plan, while working full-time for a qualifying employer, to have the remainder of their balance forgiven. Detailed requirements about how to qualify for forgiveness under this program are provided on the Public Service Loan Forgiveness page.

In 2012, Federal Student Aid introduced the Employment Certification Form (ECF), which borrowers can submit to verify that their employment qualifies for the PSLF Program. Although the form is voluntary, borrowers are strongly encouraged to submit an ECF annually or whenever they change jobs to help track their progress. In 2018, Federal Student Aid launched the PSLF Help Tool, to—among other things—help borrowers better assess their eligibility for PSLF loan forgiveness and decide which PSLF form to submit.

The Consolidated Appropriations Act, 2018 provided limited, additional conditions under which borrowers may become eligible for loan forgiveness if some or all of the payments made on Direct Loans were under a nonqualifying repayment plan for PSLF. This reconsideration is referred to as the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) opportunity. Detailed information about the limited opportunity, including how to request consideration, is available on the TEPSLF page.

In April 2021, the PSLF report was redesigned to support the new combined form that was implemented in November 2020. Borrowers now certify their employment, request an updated qualifying payment count, and apply for forgiveness under the PSLF or TEPSLF programs through a single, combined form. Reports prior to April 2021 are based on whether the borrower submitted an ECF or a forgiveness application.

On Oct. 6, 2021, the U.S. Department of Education (ED) announced a change to PSLF program rules for a limited time as a result of the COVID-19 national emergency. While these changes are not reflected in the current PSLF reporting, approximately 100,000 borrowers have qualified for forgiveness under the PSLF limited waiver as of early March 2022. Get additional information about these borrowers here.